Welcome to cold weather! Winter is rapidly approaching and, yes, real estate is slowing down a bit with the season. What's great is 2012 has seen us regain a much more "normal" market cycle! With the past many months of relative stability, we've seen an increase in straight (non-distressed) sales with considerably easier closings. Whew! Honestly, it has been a much more positive year, even with the continued "shadow inventory" of short sales and foreclosures.

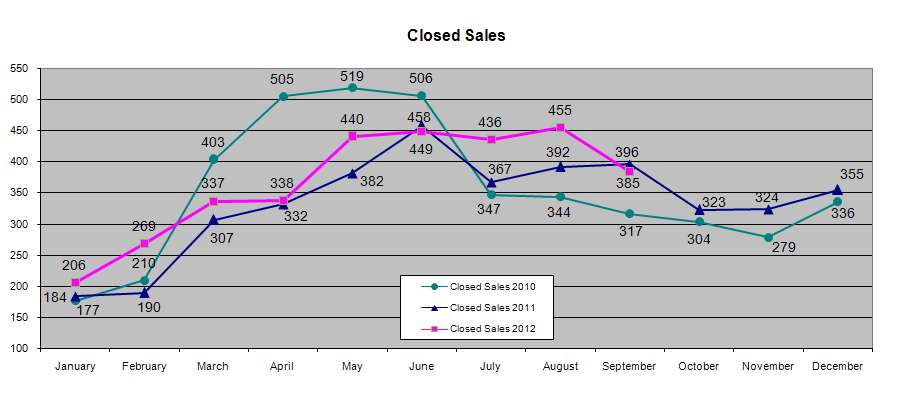

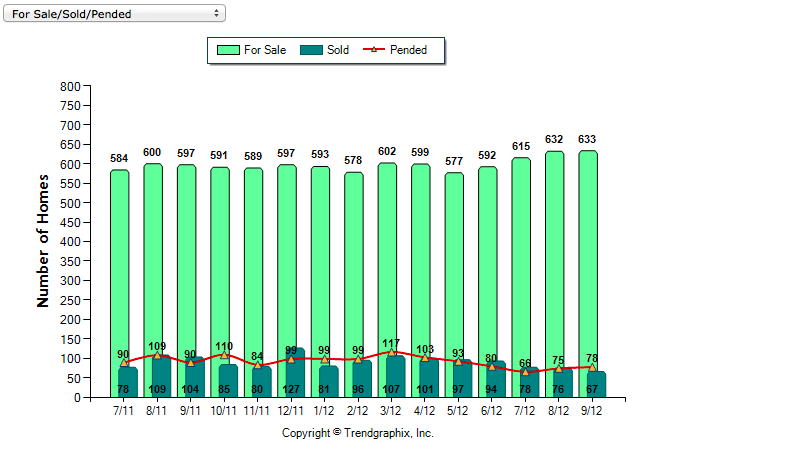

Here's what September's stats looked like:

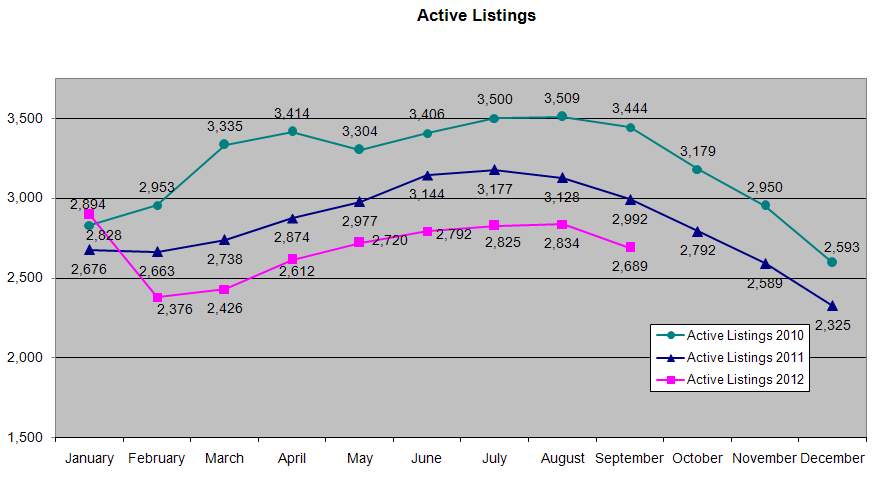

Year-to-date Active Listings have come down 10.1%. Less inventory creates more demand and helps stabilize our market.

From August to September, inventory continued to drop (10.1%). We also saw a slight decrease in sales price, down 2.1% from the end of August (the end-of-summer, start of school slow down). Why the decrease in sales price? Don't get discouraged!! That just means more homes with lower price tags were selling then homes with higher price tags. It does not mean home values decreased.

Our year-to-date unit sales increased 9.8% (everyone's very glad to see the 2012 pink line keeping fairly steady above 2011's dark blue line):

More positive news … homes under the $175,000 mark are continuing to see multiple offer scenarios. This evens the playing field, and helps sellers negotiate with a little more solid ground underfoot than what they've been dealing with in the previous couple of years. You gotta know, if sellers are more confident, it's a good thing all around!

Now then, with regard to that "shadow inventory," here's the skinny. Short sales continue to be the burr in everyone's side. The numbers have increased from 437 a year ago to 531 currently. Adding to the problem, we're still struggling with the difficult processes and longer timelines to get these transactions closed. Why you may ask? The labor intensity is daunting not to mention the minimal and sometimes variable compensation, for attorneys and brokers alike, is discouraging. It's the truth, that the long term liability issues make having good legal advice an important factor, yet finding an attorney willing and able to take on these case loads is getting more difficult. Top that off with the stress loads on sellers and time loss and frustration for buyers, and it's a potent mix of un-fun where no one comes out ahead.

Don't despair, though, it's not 100% bad news in the distressed property arena. Foreclosures / bank owned property numbers have dropped since last year; from 171 to 102. Plus, these transactions have been better streamlined and are getting easier to close, especially through Fannie Mae and HUD.

Long story short, we're not seeing any easy or quick answers for the distressed properties out there. They're simply a necessary evil that we've gotten ourselves stuck with and, until we work through it, it's a learning example of what to avoid in the future in order to maintain a healthy real estate economy.

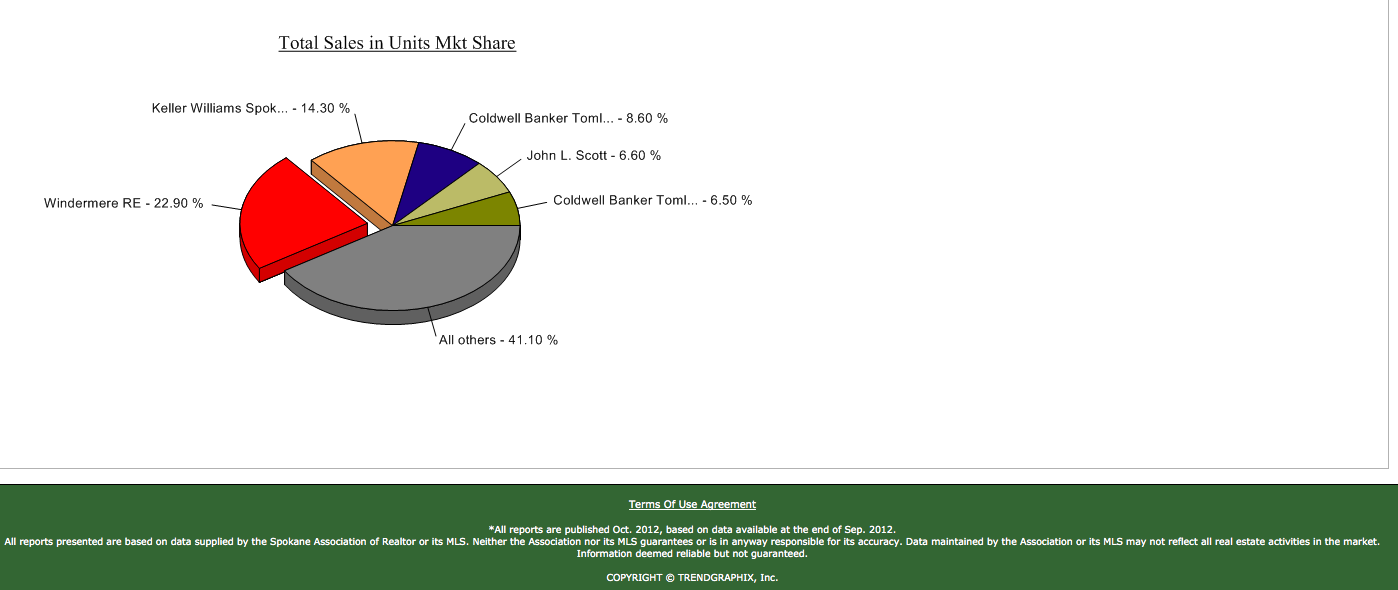

That's it in a nutshell! And to close this page with a "Woohoo!", I have to let you check out the brokerage market standings in Spokane … Steady as a rock … Way to go Windermere!! I am proud to be associated with this all American company whose standards and ethics go above and beyond any measly norm. 🙂

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link