Happy New Year!

2013 is sizing up to be pretty stable, promisingly improved, and possibly even fun. I'm not just saying that either. The final quarter of 2012 was positively positive for many folks out there, and a little bit of positive energy can go a long way if you take it by the tail and run with it. Of course, it helps to see the stats, so let's take a look at what the numbers have done in and around Spokane…

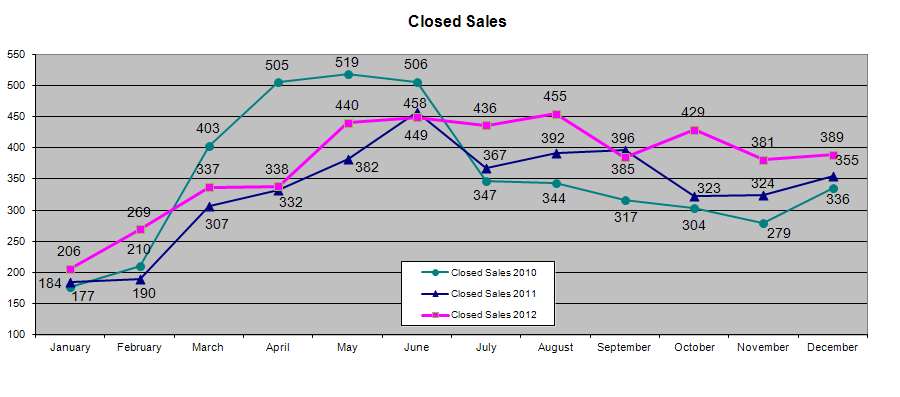

2012 saw an increase in home sales of 12.3% over 2011. People are more confident and are taking advantage of the low interest rates (3.375% on a 30 year this morning!!) to buy their new homes. That pink line is the one that makes me smile. The green one, with the hump from April to June, represents that tax credit bubble… Just look what it did to us in the end of 2010; crash and burn, yikes.

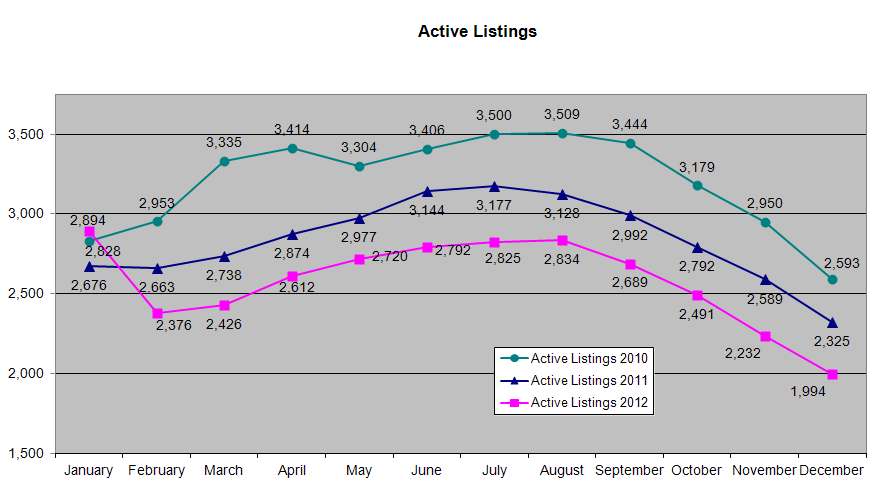

2011 to 2012 inventory is down 14.2%. This has effectively moved us toward a more balanced market; no, it's not balanced yet. It's still a buyers market, but it's shifted enough that sellers are not seeing such agonizing losses. Hopefully this reflects a lot fewer people in trouble and having to sell which is what I saw in the people I worked with the past year. No question: It's much better to buy and sell because you want to…

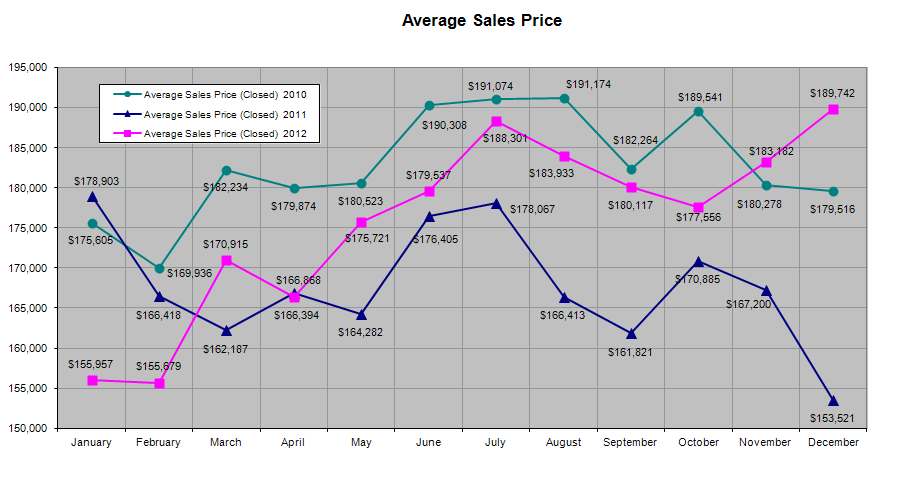

The average sales price from November 2012 to December 2012 went up 3.6%. Though slight, homes under the $175,000 mark are seeing the most gains in both price and multiple offer scenarios. Properties priced over that number have stabilized and are seeing increasing sales (which explains this average sales price increase).

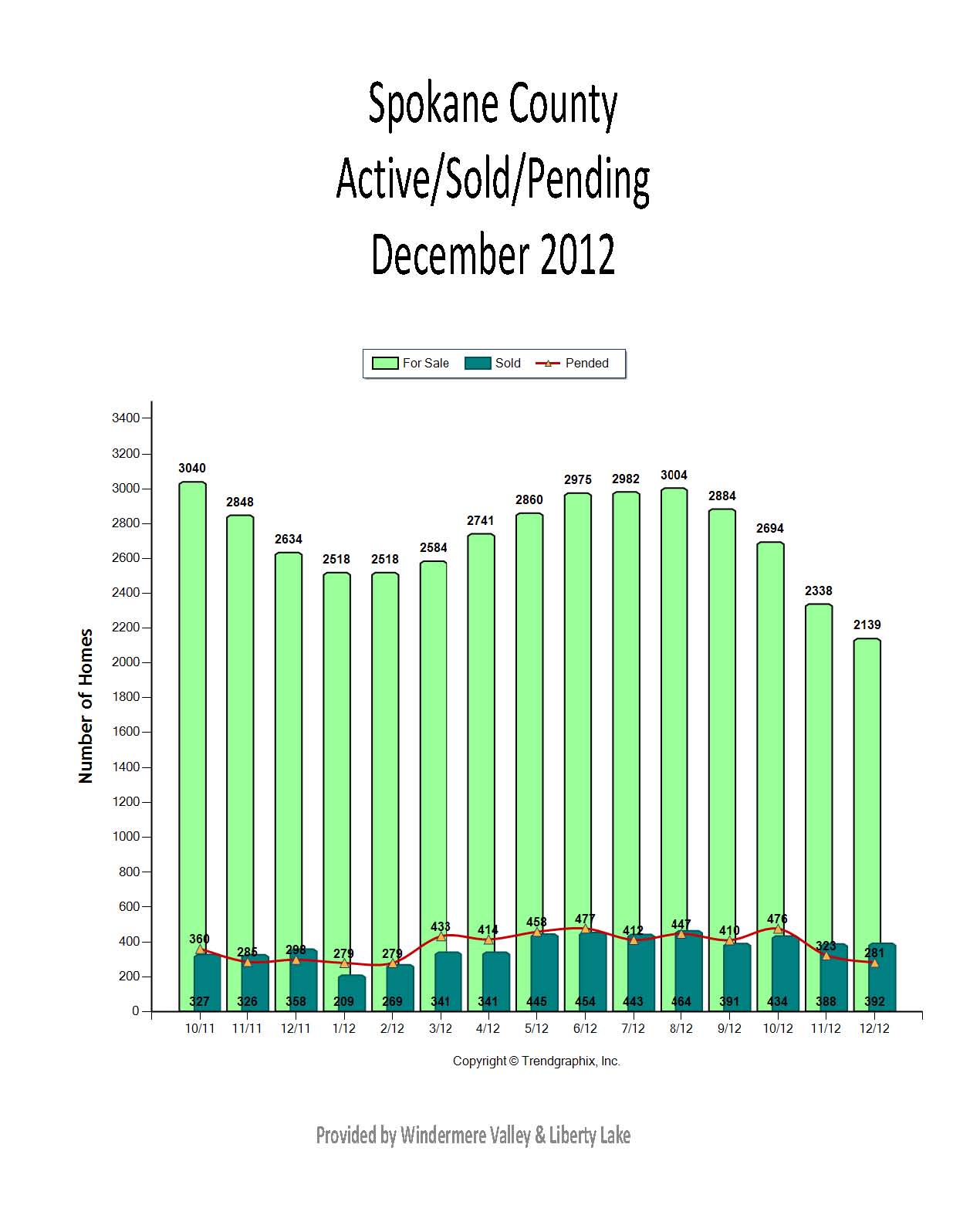

And here's a look at the past year (plus) in Active/Sold/Pending ratios:

So! Thank you, 2012, for a relatively good year, and here's to continuing the trends all the way thru 2013 and on. Let's take our valuable lessons and apply them to generate an engaging and lucrative United States economy that will do us all proud!

All my best to you & yours in the coming year,

Becky

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link